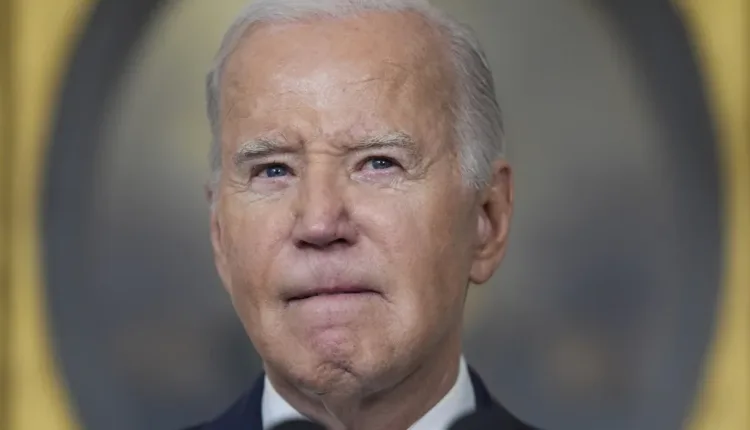

Biden’s Policy Aids IRS in Collecting $851B from Ultra-Wealthy

TL/DR –

The Internal Revenue Service (IRS) is set to collect hundreds of billions of dollars of additional tax revenue from the outstanding and overdue taxes of the ultra-wealthy, funded by President Biden’s Inflation Reduction Act. The Treasury Department and the IRS estimate that tax revenues will rise by up to $561 billion from 2024 to 2034 due to increased enforcement, and could reach $851 billion if the funding is renewed. The IRS is focusing its efforts on wealthy individuals and businesses with unpaid or overdue tax bills, not on families earning under $400,000 per year.

IRS to Collect Additional Tax Revenue from Ultra-Wealthy via Biden’s Inflation Reduction Act

The Internal Revenue Service (IRS) is set to collect additional tax revenue from the ultra-wealthy, made possible by funding from President Biden’s Inflation Reduction Act (IRA).

Treasury Department and IRS: Expected Rise in Tax Revenues

Estimates released by the Treasury Department and the IRS project tax revenues to increase by $561 billion from 2024 to 2034 due to increased enforcement enabled by IRA funding. These revenues could reach up to $851 billion if IRA funding is renewed.

IRS Collection from Wealthy Taxpayers and Biden’s Tax Plans

Using 2022 IRA funds, the IRS collected over $520 million from 1,600 millionaires with unpaid tax bills exceeding $250,000. Its focus is on wealthy individuals and businesses, not families earning below $400,000 annually. President Biden has also proposed a billionaire tax and pledged not to increase taxes on families earning below $400,000 annually.

Challenges Faced by The IRS in Tax Collection

The IRS faces major challenges in tax collection, with the tax gap—the difference between taxes owed and taxes paid—estimated at over $600 billion yearly. The IRS has experienced a significant decline in audit rates of millionaires and corporations due to budget cuts over the past decade. The IRA funding has, however, come at a crucial time for the agency.

Republican Lawmakers Attempt to Cut IRS Funding

Republican lawmakers are endeavouring to cut IRS funding. This move comes only weeks after news of a tax loophole that allowed the richest Americans to accumulate $8.5 trillion in untaxed profits in 2022 surfaced. Despite the evident returns on investment, House Republicans negotiated about $20 billion in cuts from the original $80 billion given to the IRS under the IRA.

—

Read More US Economic News