Exploring the Inflation Reduction Act’s Effect on Medicare Drug Costs

TL/DR –

The Inflation Reduction Act (IRA) is a piece of legislation aimed at reducing drug prices and providing relief for Medicare patients by capping out-of-pocket spending and permitting Medicare to negotiate the prices of certain high-cost drugs. However, it could also potentially affect innovation for new orphan drugs for rare diseases, as exemption from price negotiations is forfeited if a drug is granted a second designation for a rare disease. The law has already saved Medicare beneficiaries and the government billions in drug costs, but has also led to increased premiums for Medicare drug plans, lawsuits from pharmaceutical companies, and has potential future implications depending on court decisions and legislative actions.

Interpreting the Inflation Reduction Act and Its Influence on Medicare Drug Costs

The Inflation Reduction Act (IRA) has instigated a substantial change in Medicare’s drug cost scheme, leading to major savings for patients. However, its provisions remain obscure to many. The Act allows Medicare to negotiate the prices of certain high-cost drugs, which could alter the pharmaceutical industry and the wider health care market. Its long-term effects depend on legal outcomes and potential legislative actions.

The Inflation Reduction Act’s Impacts on the Pharmaceutical Industry

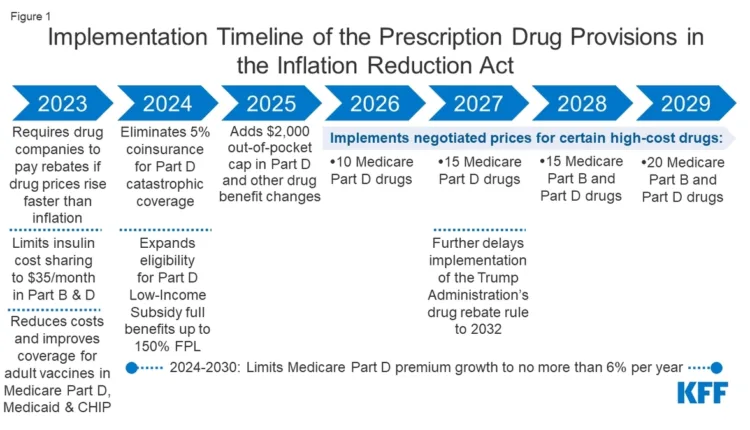

As per the Inflation Reduction Act, the Centers of Medicare and Medicaid Services (CMS) must negotiate prices of select high-cost prescription drugs beginning in 2026. Initially, this negotiation eligibility applies to only 10 drugs under Medicare Part D, increasing yearly thereafter. From 2028, Medicare Part B drugs will also be included. This may potentially affect the innovation of orphan drugs for rare diseases. Companies could be discouraged from seeking approval for multiple disease treatments if the second disease’s drug loses its negotiation exemption. This has already impacted a drug for Stargardt Disease

Substantial Savings for Medicare Beneficiaries Due to the Inflation Reduction Act

The IRA has significantly reduced drug prices, resulting in savings for Medicare beneficiaries and government cost reductions. The Act places a cap on out-of-pocket expenses for patients, allows Medicare to negotiate certain high-cost drug prices, provides free vaccines and subsidized insulin to low-income patients. However, it has also led to heightened Medicare drug plan premiums and pharmaceutical company lawsuits. Although the Congressional Budget Office predicts a $237 billion federal government saving over 10 years, the number of market drugs may reduce.

Pharmaceutical Companies’ Response to the Inflation Reduction Act

Pharmaceutical companies have reacted to the IRA with lawsuits and legislation aimed at increasing transparency and curbing anti-competitive behaviour in the industry. Alongside this, the Biden administration works on efforts complementary to the Act, including proposed bills for transparency and investigations into anti-competitive pharmacy benefit managers and drug company actions. There’s also a potential plan for seizing unreasonably priced drugs developed through National Institutes of Health-funded research.

Public Awareness and Upcoming Implications of the Inflation Reduction Act

Despite the significant changes due to the IRA, public cognizance remains low. It’s essential to emphasize the potential savings and drug availability reductions predicted by the Congressional Budget Office. The future of the Act relies on legal challenges, potential negotiations, and responses from pharmaceutical companies and beneficiaries. While it marks a significant step towards lowering drug prices and providing relief for Medicare patients, its long-term impact is contingent on court decisions and future legislative actions.

—

Read More US Economic News