United India to Launch Retail Cybersecurity Insurance in Chennai

TL/DR –

United India Insurance plans to enter the retail cybersecurity insurance market with three products providing insurance cover for laptops and personal computers against cyber attacks. The policies, to be launched before March 2024, will provide coverage for refurbishing or replacing affected gadgets and data retrieval expenses. The company already offers cybersecurity insurance in the corporate sector, and with the Indian cyber insurance market expected to grow at a 27%-30% compound annual growth rate in the next 3-5 years, it hopes to gain a premium of Rs 20-25 crore ($3-$4 million) during the first year.

United India Insurance Ventures into Retail Cybersecurity Insurance

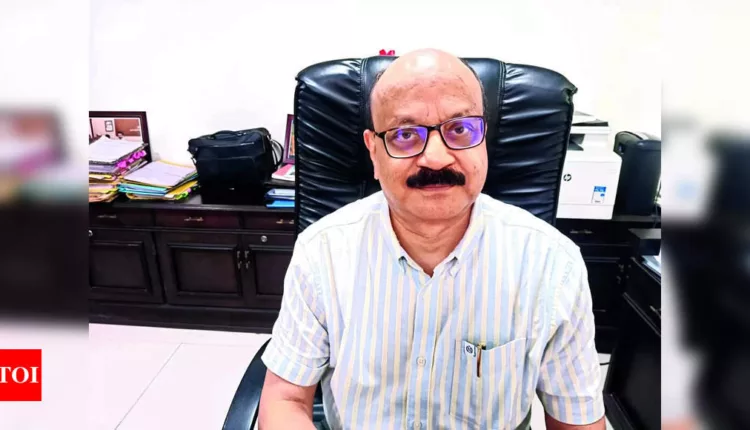

United India Insurance, a public sector company, is set to introduce three retail cybersecurity insurance products offering protection for personal computers and laptops against cyber attacks. The company’s CMD, Satyajit Tripathy, revealed that the new policies will be launched before March 2024. The growing cybersecurity threats and increasing demand for retail insurance for digital devices could generate a premium of Rs 20-25 crore in the first year of FY25.

The new insurance policies will cover the costs of refurbishing or replacing the affected devices, along with expenses related to data retrieval. The company already provides cybersecurity insurance in the corporate sector.

A Deloitte market report cited by national investment promotion agency, Invest India, values India’s cyber insurance market between $50 million and $60 million. It’s projected to grow at a CAGR of 27%-30% over the next three to five years, and according to CERT-IN, India’s national agency for dealing with cyber security, the country experienced approximately 1.4 million cybersecurity incidents in 2022 alone.

In FY24, the Chennai-based insurer is aiming for a Gross Written Premium (GWP) of Rs 19,800 crore, reflecting a growth of nearly 13% from the previous year’s GWP of Rs 17,644 crore. The insurer’s portfolio primarily consists of health insurance (40%), motor policies (34%), and the remainder shared between property and crop insurances. Tripathy noted that motor insurance premiums grew by 18% in H1 FY24 compared to the same period in FY23.

Despite the positive growth trajectory, United India Insurance is also focusing on enhancing its financials following a widening loss from Rs 2,135 crore FY22 to Rs 2,829 crore in 2022-23. The losses in FY23 were primarily due to wage arrears amounting to Rs 2,900 crore. However, Tripathy assures progress with a recorded profit of Rs 204 crore in Q2 of FY24, projecting an improved overall financial performance for the current year. As of March 31, 2023, United India Insurance serves approximately 1.4 crore policyholders.

Recommended Articles

Read about the impact of discontinuing an insurance policy

Discover five aspects your car insurance may not cover

Learn about the new proposed rules for discontinuing an insurance policy

—

Read More Health & Wellness News ; US News