Evaluating Biden’s Major Climate Legislation

TL/DR –

The Inflation Reduction Act (I.R.A.) is projected to cost more than $800 billion through 2033, according to the Congressional Budget Office. The Act, aimed at reducing emissions, is expected to add $250 billion more to the deficit than initially forecast. However, it has also reportedly led to about $282 billion in investment and approximately 175,000 jobs in its first year.

What Does the Inflation Reduction Act Mean for America’s Economy?

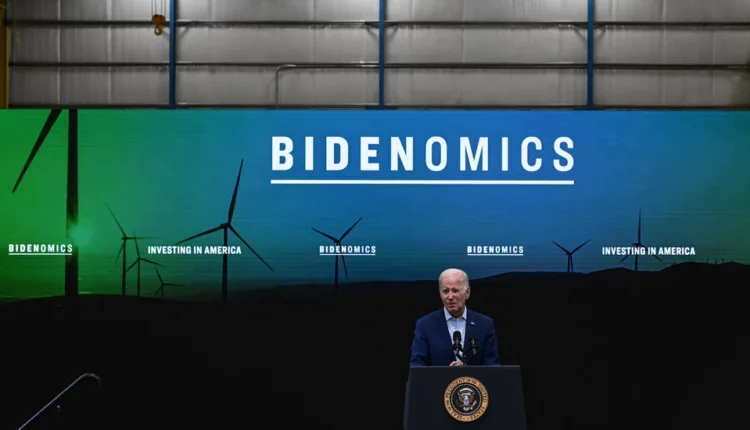

President Biden’s Inflation Reduction Act (I.R.A.) is facing scrutiny as questions regarding its impact on the federal deficit remain unanswered. The I.R.A., costing over $800 billion through 2033, is substantially higher than the initial $391 billion estimated in 2022, as stated by the Congressional Budget Office.

The act promotes green energy initiatives, with increased demand for the credits and subsidies it provides for solar, hydrogen, and nuclear energy projects, as well as electric vehicles. An analysis by Goldman Sachs reveals that the act led to approximately $282 billion in investment, creating 175,000 jobs in its first year.

Despite the environmental benefits, the I.R.A. is expected to add $250 billion more to the deficit than initially forecast despite cost-saving promises by the White House. Additional tax-collection resources provided by the I.R.A. could potentially aid the I.R.S. in gathering up to $851 billion more in tax revenue over the next decade, leading some to consider it as a deficit-reducing law.

The I.R.A.’s international economic impact is also notable. Chinese solar energy giants are taking advantage of the law’s tax breaks to build American solar panel factories, challenging the goal of fostering a homegrown greentech industry. Furthermore, the act’s popularity has strained relations with American trading partners, including the E.U., which is developing its own version of the law.

The future of the I.R.A. is uncertain, with Donald Trump threatening to overturn it if re-elected, a move that business leaders warn could significantly impact American industry.

OpenAI’s Trillion-dollar Ambition

OpenAI is leading the race in artificial intelligence (AI) development, with its technology driving substantial growth for itself and its biggest investor, Microsoft. CEO Sam Altman has ambitions to reshape the global semiconductor industry, investing trillions of dollars to boost AI chip production.

China’s Unbroken Supply Chain

Despite the pandemic and increasing tensions with the U.S., China remains a global manufacturing powerhouse. This is evident in data showing the U.S. imported more goods from Mexico than from China last year.

China continues to benefit from its migrant workforce, with approximately 300 million workers contributing to the country’s manufacturing sector. The Lunar New Year highlights this, as it triggers the world’s largest annual mass migration event.

Companies like Apple, which has a significant manufacturing base in China, illustrate the challenges of replacing this infrastructure. Apple’s attempts to expand in India face hurdles, including a workforce that cannot move en masse across the country, language differences, and substandard production quality.

A Lawsuit Over Goldman Sachs’s Conflicting Responsibilities

A new lawsuit over M.&A. is challenging Goldman Sachs’s ability to manage multiple, and sometimes competing, clients. KSFB, a celebrity management firm, has accused Goldman Sachs of deception when shopping it to potential buyers while negotiating the sale of a bigger client.

—

Read More US Economic News