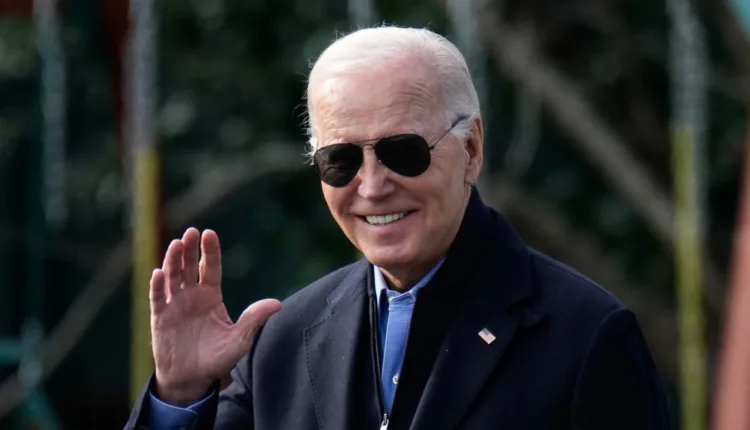

Time to Dismantle Biden’s Favored Climate Law: Faulkender & McPherson-Smith

TL/DR –

Under President Biden’s term, consumer prices have risen 17% driven by a 32% surge in energy costs. The Inflation Reduction Act (IRA), a major legislative achievement under President Biden, is seen as the culprit as it is believed to deter reliable, affordable energy investment, compound security issues, and fail to provide clear rules for new energy technologies. The article argues for the repeal of the IRA, and the adoption of an “all of the above” energy policy that promotes competition, consumer choice, and the efficient use of America’s diverse natural resources.

Consumer Prices and Energy Costs Surge under Biden: A Look into the Inflation Reduction Act

Consumer prices have risen by over 17% under President Biden’s three-year term, fueled by a 32% leap in energy costs. This increase challenges American energy security, already threatened by precarious electricity grids and Russian and Iranian pushes for higher oil prices to finance their conflicts. JD Foster criticizes Biden’s administration for its approach.

Meanwhile, American energy production has only just returned to pre-pandemic levels. The president’s major legislative victory, the Inflation Reduction Act (IRA), is chiefly to blame. Rather than discouraging Russia and Iran, Biden administration officials are using IRA subsidies and tax incentives to deter investment in affordable, reliable energy, aggravating our security issues.

Controversy Surrounds the IRA’s Electric Vehicle Tax Credit

The Department of the Treasury recently divulged its much-anticipated eligibility criteria for the IRA’s electric vehicle tax credit. Despite China emitting over double the carbon of the U.S, Treasury’s criteria have undermined IRA provisions that were meant to stop the tax credit from subsidizing Chinese miners and mineral refiners.

Sen. Joe Manchin, a key vote in the climate law’s passage, has committed to backing any lawsuit against this approach.

IRA’s Hydrogen Tax Credit and Energy Security

Further energy security issues arose following the recent COP 28 climate conference, where the Biden Administration promised to triple nuclear energy capacity by 2050. But, bureaucracy bungled the release of the IRA’s hydrogen tax credit in less than a month.

Nuclear facilities, which generate about 46% of America’s carbon-free electricity, are denied this lucrative IRA benefit to favor wind and solar industries. Also, there are no clear rules for permitting interstate hydrogen pipelines amid a rush to deliver taxpayer dollars to preferred industries, neglecting safety regulations vital for any energy technology.

The Future of America’s Energy Policy

The IRA reflects the overconfidence common to all socialist master plans, demonstrating the government’s inability to realize the progressives’ utopian dream. Top-down, command-and-control models don’t work for reliable, affordable energy.

We should embrace free-market capitalism that leverages America’s plentiful energy resources and promote a competitive, consumer-friendly “America First” energy policy, rather than distortive tax credits. This policy would efficiently use America’s diverse natural resources, without a single-minded focus on green energy.

Oil and gas drilling, nuclear, hydrogen, carbon capture, and yes, electric vehicles, all have potential roles in America’s energy and transportation sectors, and they should all compete in the free market. The Department of the Interior pursued this “America First, all of the above approach” in May 2020 when it permitted the then-largest solar project in American history.

The IRA, a coercive example of central planning, manipulates consumer choice, picks winners and losers, and imposes a hefty burden on future generations. For real energy security, economic growth, and lower prices, the next administration should fully repeal the IRA’s energy and environment provisions within its first hundred days, coupled with the reinstatement of competitive and federal “all of the above” energy policies.

—

Read More US Economic News