Unleashing IRS Potential: Decoding the Impact of the Inflation Reduction Act | CEA

TL/DR –

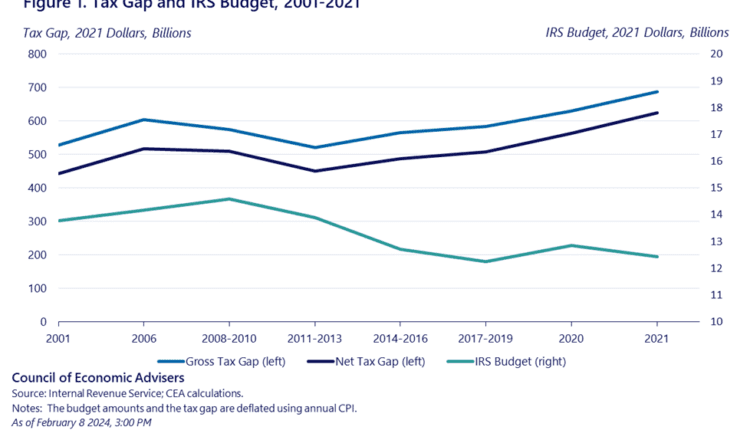

The gross tax gap, or the difference between taxes owed and paid, reached $688 billion in 2021, with a net tax gap of $625 billion after IRS enforcement efforts. President Biden’s Inflation Reduction Act provided $80 billion in additional funding for the IRS, mainly aimed at enforcing tax compliance by wealthy tax evaders and reducing the tax gap. New analysis from the U.S. Department of Treasury and the IRS show that this investment, if sustained beyond 2031, would increase tax revenue by up to $851 billion over the next ten years; such an increase in revenue would contribute to the country’s tax fairness and deficit reduction efforts.

President Biden’s efforts to narrow tax gap

President Biden has made considerable strides in balancing the tax code by providing the Internal Revenue Service (IRS) with the necessary resources to decrease the tax gap and enhance taxpayer services. This tax gap, which is the difference between owed and paid taxes, was a sizable $688 billion in 2021, with a net tax gap of $625 billion after considering IRS enforcement actions. The Inflation Reduction Act provided significant funding to the IRS, a substantial portion of which is aimed at reducing the tax gap by enforcing tax compliance among the wealthiest tax evaders.

Benefits of sustaining Internal Revenue Service (IRS) funding

A recent analysis from the U.S. Department of Treasury and the IRS suggests that this historic funding, if continued beyond 2031 as President Biden proposes, could yield significant returns. The IRS estimates a potential increase in tax revenue by as much as $851 billion over the next decade, thereby improving tax compliance and fairness.

Struggles faced by the IRS

The IRS suffered from dwindling budgets for years before the IRA investment, with the budget decreasing from $15.1 billion to $12.4 billion between fiscal years 2010 and 2021 after accounting for inflation. This loss of resources, coupled with increasing responsibilities such as implementing significant legislation and distributing pandemic stimulus payments, has been a major contributor to the growing tax gap, which stood at $688 billion in 2021.

The significance of closing the tax gap

Closing the tax gap is crucial for boosting tax fairness and the federal fiscal outlook. The tax gap represents uncollected revenue that can be allocated towards various spending priorities. The IRS estimates that about 86 percent of taxes were paid voluntarily or collected by IRS enforcement in 2021, indicating a 14 percent potential increase in revenue from uncollected taxes.

IRS focus on the wealthiest taxpayers

The tax gap is primarily driven by income sources held by the wealthy. Business income reported on individual and corporate tax returns accounted for 7 and 26 percent of the 2021 gross tax gap, respectively. The top 10 percent of the income distribution is responsible for 64 percent of unpaid taxes. With an average of 72 percent decline in audit rates for tax returns between 2010 and 2019, the IRS is now focusing its efforts on these high-income taxpayers, aligning with the commitment of Treasury Secretary Janet L. Yellen to not increase audit rates for small businesses and taxpayers earning less than $400,000.

The potential impact of the IRA provisions

The new report estimates that implementing the IRA provisions could raise $851 billion in new revenue, equivalent to a 2.5 percent reduction in the debt-to-GDP ratio in FY2033. Funding the IRS to reduce the tax gap would significantly enhance the nation’s tax fairness, particularly benefiting working families who already pay their due taxes. It is time for the wealthiest households to follow suit.

—

Read More US Economic News