Globalisation Not Declining, Just China’s Dominance

TL/DR –

Joe Biden’s administration has launched the White House Council on Supply Chain Resilience as part of its effort to strengthen the US economy and its manufacturing capacity. This move, along with the Inflation Reduction Act, is viewed as a shift towards local production and could disrupt global supply chains and international trade, impacting every US trading partner except possibly Mexico. This policy change comes against the backdrop of China’s reduced economic output and a growing trend of companies reducing their dependence on China and moving towards countries like India, Mexico, and Vietnam.

USA vs. China in the Battle of Supply Chain Resilience and International Trade

Joe Biden’s latest policy has alarmed China, pointing to a paradigm shift in global supply chains and international trade. The introduction of The White House Council on Supply Chain Resilience is a key element of the Biden administration’s strategy to fortify the US economy and manufacturing potential.

Referred to as “Bidenomics,” these efforts aim to decrease costs for American families, ensuring the timely availability of essential products while promoting well-paying, domestic union jobs. The Inflation Reduction Act introduced concurrently is thought to stimulate US electric vehicle production, putting local interest before international.

Expert John Manners-Bell, in his latest book, The Death of Globalisation, characterizes the Inflation Reduction Act as both landmark legislation and a protectionist measure impacting all US trading partners, excluding possibly Mexico. However, he argues it could backfire.

Despite potential drawbacks, the Biden administration has been successful in resolving serious supply chain problems. The Inflation Reduction Act forms part of a package of policies that have alleviated supply chain pressures, from near-record highs during Covid, to pre-pandemic levels.

In contrast, China faces a decreased economic output with a lower projected 2024 GDP according to the World Bank. The country recorded its first-ever quarterly deficit in foreign direct investment this month. A US-China Business Council survey reveals a rise in halted or reduced Chinese investments, with 73% citing cost increases and China-US tensions.

An Office of Textiles and Apparel poll revealed China is no longer the primary supplier for 61% of American businesses. These trends are beneficial to Mexico, which solidified its position as the top US trading partner this year.

On the heels of these developments, discussions about decoupling from China and implementing China+1 strategies are ongoing. China’s premier Li Qiang appealed against “the rise of global protectionism” at the first China International Supply Chain Expo.

These developments challenge China’s dominance over globalisation, suggesting a shift in its influence. Tsai Ming-fang, economics professor at New Taipei’s Tamkang University, stated that businesses are relocating to countries like India, Mexico, and Vietnam, reducing dependence on China.

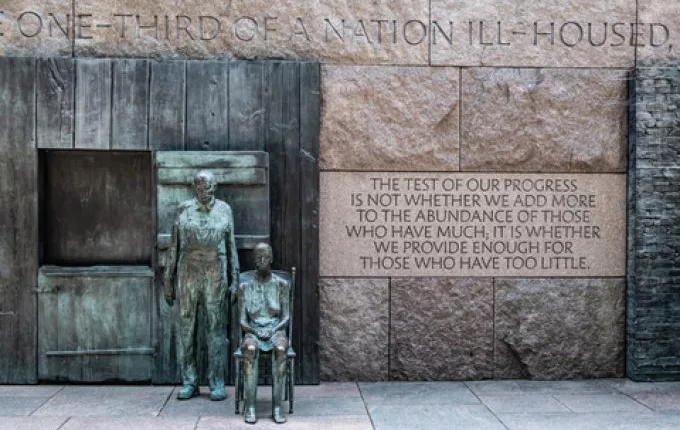

Biden’s underlying intention might have been to trigger this decoupling from China. However, it is clear that his objective was to restore US manufacturing dominance, reminiscent of FDR.

—

Read More US Economic News