Exploring the $35 Insulin Cap and Inflation Reduction Act Impact

TL/DR –

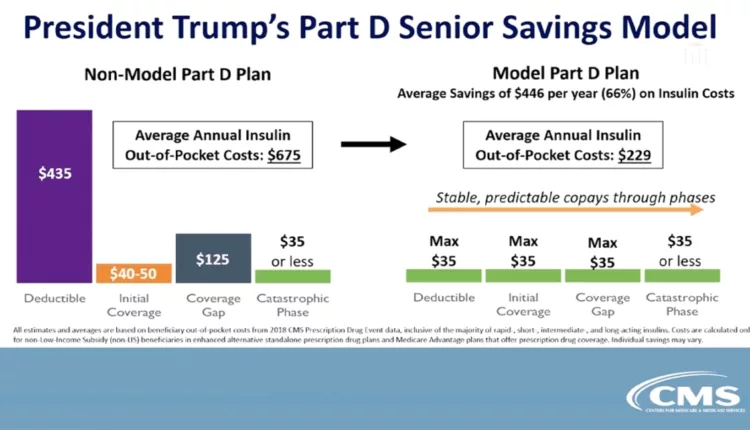

Under new initiatives, Medicare Part D and Part B now cap the cost of a one-month supply of insulin at $35, with no deductible needed. This change is part of President Biden’s Inflation Reduction Act, which aims to reduce the price of medication by targeting price gouging and allows Medicare to directly negotiate drug prices, capping the cost of insulin for Medicare beneficiaries. The Act also introduces provisions like free vaccines under Medicare Part D and a cap on drug price increases.

Grasping the $35 Cap on Insulin Expenses

Insulin costs have been a profound concern, especially for diabetes patients. Medicare Part D and Part B have taken steps to alleviate this stress by capping a one-month supply of insulin at $35 with no deductible. This limit ensures patients pay no more than $105 for a three-month insulin supply, offering significant relief.

Impact of the Inflation Reduction Act’s Provisions

The changes result from President Biden’s Inflation Reduction Act, aimed at mitigating Big Pharma’s price gouging. This noteworthy legislation potentially saves seniors thousands on medication by requiring pharmaceutical companies to rebate Medicare after unjustified price increases.

Moreover, Medicare can directly negotiate lower prescription drug prices, keeping the insulin cost under $35 for beneficiaries. Companies that increase prices faster than inflation must pay rebates. In 2022, Medicare Part D beneficiaries paid $3.4 billion out-of-pocket on the ten negotiable drugs. These negotiated prices will take effect for seniors in 2026.

Tackling the Escalating Insulin Cost

The surging insulin cost has been a serious concern, putting financial pressure on those dependent on it. Efforts from lawmakers and advocacy groups aim to make insulin more affordable. Various Medicare Part D schemes and tools help estimate drug costs, including insulin. Patients can now secure a one-month insulin prescription for $35 or less, significantly lowering their expenses.

Medicare’s Diabetes Care Coverage

Medicare offers extensive coverage on several aspects of diabetes care, including blood sugar test strips, continuous glucose monitors, and antidiabetic drugs. In 2024, the standard Part B premium will be $174.70, while Part D plans will vary in premiums and deductibles.

Medicare also covers diabetes equipment and supplies under Part B with some covered under Part D. Part B covers disease management services for diabetics, preventative services for those at risk, and certain types of insulin. Part D covers a wide range of other antidiabetic medications.

Promoting More Affordable Prescription Drugs

The Prescription Drug Provisions of the Inflation Reduction Act aim to make drugs more affordable for Medicare beneficiaries. These provisions include Medicare drug price negotiation, free vaccines under Medicare Part D, an out-of-pocket maximum, caps on insulin costs, and drug price increases. By addressing price gouging and introducing cost caps, this Act significantly alleviates patient expenses.

—

Read More US Economic News