Understanding Impacts on Lehigh Valley Health Care

TL/DR –

Lehigh Valley Health Network and Philadelphia-based Jefferson Health are planning to merge, creating the second largest health network in Pennsylvania. The merged entity would encompass a national research university, a non-profit health plan, 30 hospitals, over 700 outpatient sites, and more than 62,000 employees, generating an estimated annual revenue of $12 billion to $14 billion. The merger is expected to improve care for underserved populations and reduce the cost of care, but there are concerns about increased costs for patients with private insurance plans due to decreased competition.

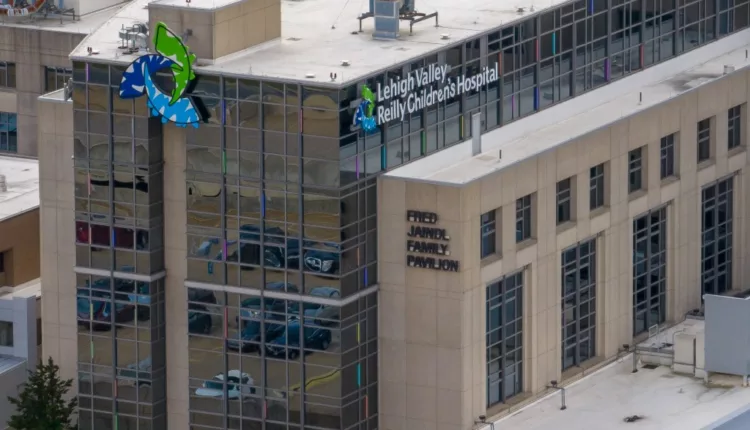

Impact of Lehigh Valley Health Network and Jefferson Health Merger

Tuesday’s merger announcement between Lehigh Valley Health Network (LVHN) and Jefferson Health could considerably alter regional healthcare. Pending approval, the merger would form Pennsylvania’s second-largest health network, generating an estimated annual revenue of $12-$14 billion.

Economist Chad Meyerhoefer suggests minimal regulatory pushback due to LVHN and Jefferson’s non-competing geographical healthcare markets. Yet, full integration of the health systems could take significant time post-approval.

The most significant shift could occur within insurance, with both networks aspiring to integrate Jefferson’s noncommercial insurance marketplace, Jefferson Health Plans, into LVHN’s operations. The goal is to enhance care for underserved populations while reducing care costs.

Jefferson Health Plans, with 340,000 insured mainly on Medicaid, has no equivalent in the Lehigh Valley. Research suggests that consolidation can lead to higher premiums for private plans due to decreased competition and increased pressure on insurance companies for better compensation.

The merger could highly benefit Medicaid patients and the underinsured through better care access. However, patients with private plans might face higher costs. The Federal Trade Commission has challenged mergers for these exact reasons.

Concerns extend to potential healthcare cost rise without equivalent patient care level increase and lower pay for front-liners. LVHN CEO Dr. Brian Nester, however, insists the merger will enhance care accessibility, reducing overall costs.

A final agreement is still under negotiation, requiring state approval, with existing hospital leadership remaining in place. Staffing impact and rebranding possibilities remain unknown.

Short-term changes could primarily involve branding and public perceptions as the merger could tip the scales in the LVHN-St. Luke’s University Health Network rivalry. The long-term effects remain to be seen.

—

Read More Health & Wellness News ; US News