Clarify Biofuel Clauses in Inflation Reduction Act

TL/DR –

The Inflation Reduction Act (IRA), enacted in August 2022, restructured biofuels tax credits by extending the Biodiesel Blenders Tax Credit, creating a sustainable aviation fuel tax credit, and shifting future biofuel tax credits to a carbon intensity model. As the end of the $1 per gallon subsidy for biodiesel and renewable diesel blending approaches in 2024, there has been an increase in demand for soybean oil. However, as the transition to the 45Z model nears, there is uncertainty for farmers, with calls for the Department of Energy’s GREET model to be used instead of bundles, which are believed to limit innovation.

The Inflation Reduction Act and its Impact on Biofuels

The Inflation Reduction Act (IRA), effective from August 2022, modified biofuels tax credits in three significant ways. It extended the Biodiesel Blenders Tax Credit (40A), initiated a sustainable aviation fuel (SAF) tax credit (40B), and shifted future biofuel tax credits towards a carbon intensity (CI) focus (45Z).

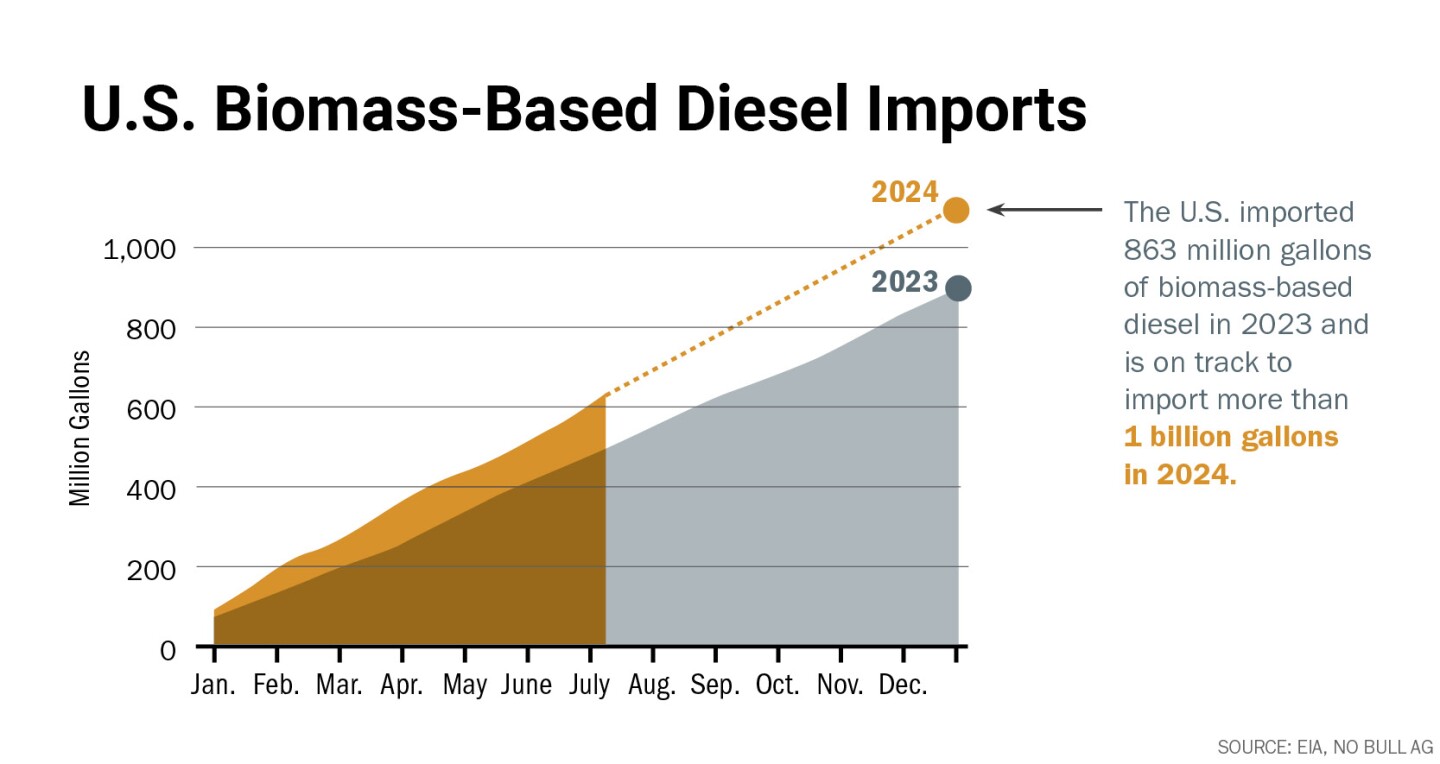

According to Susan Stroud from No Bull Ag, both 40A and 40B are included in 45Z, transitioning blending into a production credit. As the year 2024 concludes, the time when 40B is offering a $1 per gallon subsidy as a blender tax credit for each gallon of biodiesel and renewable diesel blended into U.S. fuel supplies, oil share has been somewhat supported as increasing mandates coincide with disincentivizing fuel imports. This could generate more demand for soybean oil.

With the upcoming transition to 45Z, the prospects for farmers remain unclear. “USDA is attempting to provide guidance to aid the Department of Treasury with the 45Z rules, but ‘climate smart’ commodities and low carbon feedstocks for biofuels are not equivalent,” explains Mitchell Hora of Continuum Ag.

Hora proposes that 45Z should implement the Department of Energy’s GREET model, as opposed to the all-or-nothing approach used with 40B and prior programs. He asserts that this change is vital, and the aftereffects of 45Z could be substantial.

A legislation proposal aims to extend the biofuels tax credit through 2025, while the Treasury’s guidance on 45Z is still awaited.

—

Read More US Economic News