Inflation Reduction Act’s Impact on Pharma’s Future

TL/DR –

The Inflation Reduction Act (IRA) is set to change how Medicare negotiates drug prices, potentially saving around $300 billion in Medicare drug costs over the next decade, but may also cause a reduction in revenues for the biopharma industry by about $75 billion. Another layer of complexity is added by the introduction of the Ensuring Pathways to Innovative Cures (EPIC) Act which aims to harmonize the negotiation period for all types of drugs to 13 years. As the pharmaceutical industry adapts to these changes, concerns are raised about the potential of disincentivizing post-approval research for small molecule drugs, emphasizing the need for policies that balance affordability and innovation.

The Inflation Reduction Act (IRA) and its Impact on the Pharma Landscape

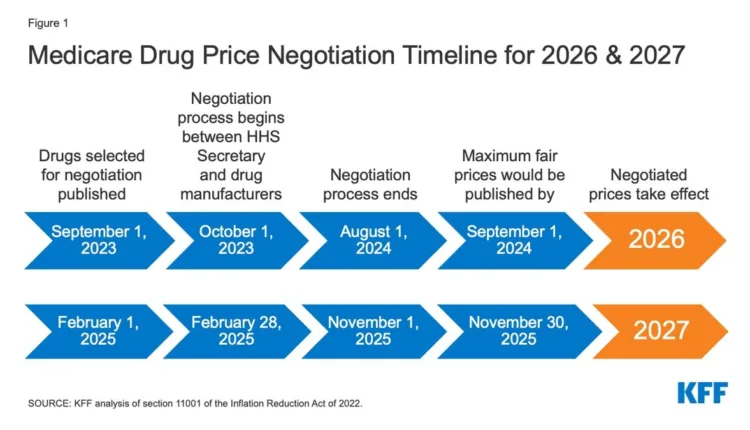

The Inflation Reduction Act (IRA) is poised to revolutionize the way Medicare negotiates drug prices, potentially resolving the complex issue of balancing pharmaceutical innovation with the affordability of life-saving drugs. The IRA projects substantial savings of nearly $300 billion in Medicare drug costs over the coming decade, marking a significant step in cost containment. However, this comes with potential revenue losses of around $75 billion for the biopharma industry due to the Act’s stringent price negotiation mechanisms.

IRA Drives Strategic Shift towards Biological Drugs

This financial overhaul is steering a strategic shift within the industry, as seen with Pfizer’s decision to reduce its focus on small molecule cancer drugs in favor of biological drugs. This move is propelled by the IRA’s differential treatment of drug types, propelling a trend towards biologics, despite their inherently higher administration costs compared to pills. This transformation sparks questions about future healthcare costs while showcasing the adaptability of the pharma industry in the face of regulatory pressures.

Impact of the Ensuring Pathways to Innovative Cures (EPIC) Act

The proposed Ensuring Pathways to Innovative Cures (EPIC) Act adds an additional layer of complexity, seeking to equalize the negotiation period for small molecules and biological drugs to 13 years. This move, however, sparks debate, as it is perceived as both a concession to the pharma industry and a potential precursor to stricter price controls on all drugs. Insights from John L. LaMattina, Pfizer Global R&D’s former president, emphasize the importance of innovation, warning against measures that might inhibit this progress.

Future Implications: The Cost of Advancement

A recent ruling in favor of the IRA, against AstraZeneca’s challenge in a federal district court in Delaware, reinforces the Act’s legality and the evolving landscape of the pharma industry. As negotiation becomes the standard and affordability takes precedence, concerns grow about the potential disincentivization of post-approval research for small molecule drugs, as noted in The American Journal of Managed Care. The challenge lies in developing policies that not only control escalating drug prices but also foster pharmaceutical research, ensuring affordability without compromising future cures.

The IRA stands as both a benchmark and stepping stone in the journey to balance innovation and affordability – a journey fraught with challenges but offering a promise of a healthier, more accessible future.

—

Read More US Economic News