LG Energy Solution obtains IRA-compliant battery minerals

TL/DR –

LG Energy Solution (LGES) has signed an agreement with lithium supplier Liontown to secure Inflation Reduction Act (IRA) compliant battery minerals. The convertible note subscription agreement extends LGES’s existing five-year offtake agreement by an additional 10 years, providing 700kt of spodumene concentrate over the first five years and 1,500kt spodumene concentrate over years 6 to 15. LGES will also invest $250 million to further production at Liontown’s Kathleen Valley Project in Western Australia.

LG Energy Solution secures IRA-compliant battery minerals

LG Energy Solution (LGES) has entered into an agreement with Tesla’s lithium supplier, Liontown, to secure Inflation Reduction Act (IRA) compliant battery minerals.

On July 4, 2024, LGES and Liontown signed a convertible note subscription, prescribing that Liontown will supply LG Energy Solution with lithium spodumene from its Kathleen project. The two companies are also contemplating the setup of a future lithium refinery.

LGES CEO David Kim expressed, “This agreement is a significant step towards strengthening our value chain investment strategy. By partnering with Liontown, we aim to secure a stable supply of IRA-compliant critical minerals and provide competitive power solutions for electrification.”

There are several key elements in the agreement between LGES and Liontown:

- Liontown will extend LG Energy Solution’s existing 5-year offtake agreement by 10 years, supplying up to 700kt of spodumene concentrate over the first 5 years and 1,500kt over the next 10 years.

- The duo will begin feasibility studies for establishing an IRA-compliant lithium refinery aimed at processing spodumene from the Kathleen Valley into battery-grade lithium chemicals.

- LG Energy Solution will invest US$250 million through Convertible Notes to support the production ramp-up of Liontown’s Kathleen Valley Project in Western Australia.

Partnering with Liontown ensures LG Energy Solution’s battery supply chain in the U.S. as it boosts 4680 production. Liontown also has lithium supply agreements with Tesla and Ford.

LGES is gearing up to start 4680 production in South Korea and prioritizing the buildout of its 4680 battery assembly line in Arizona.

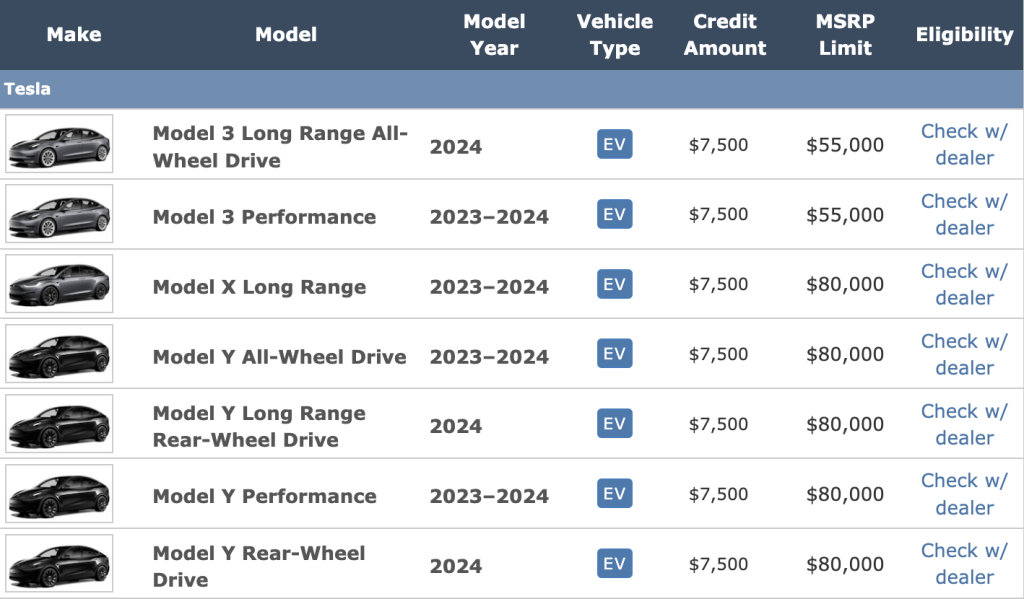

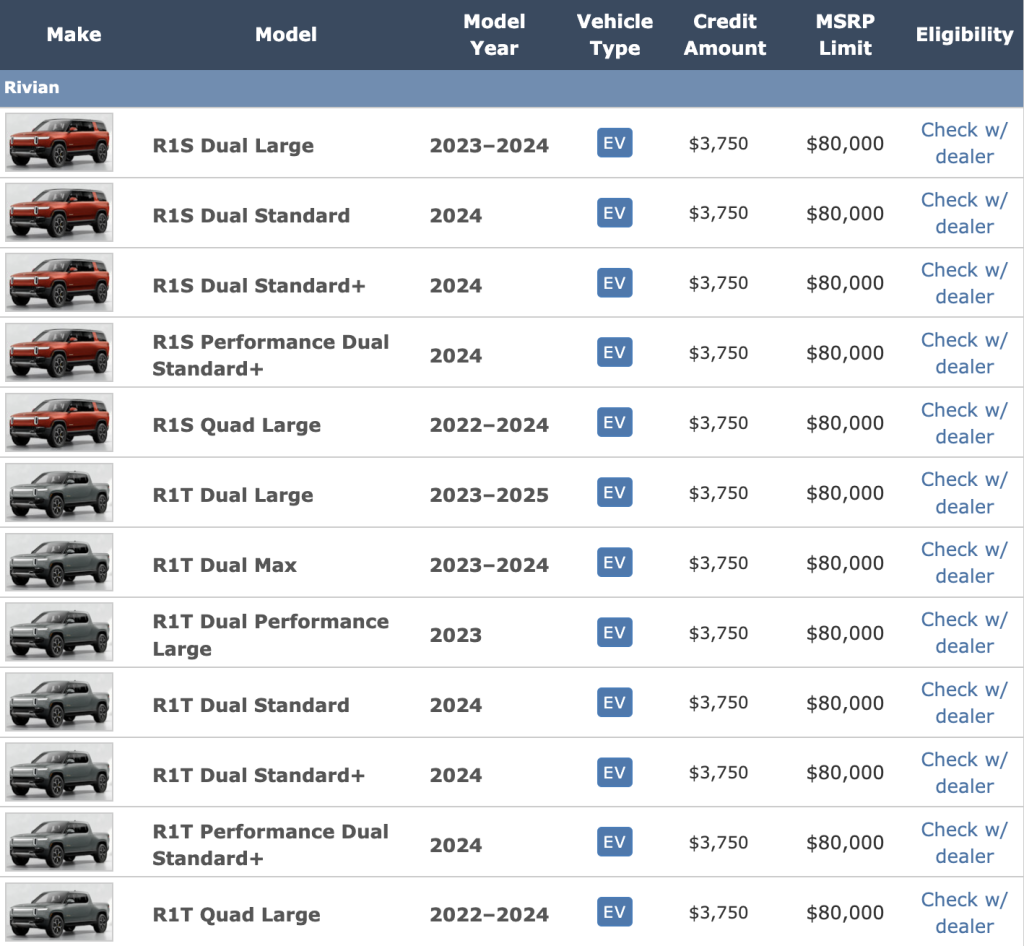

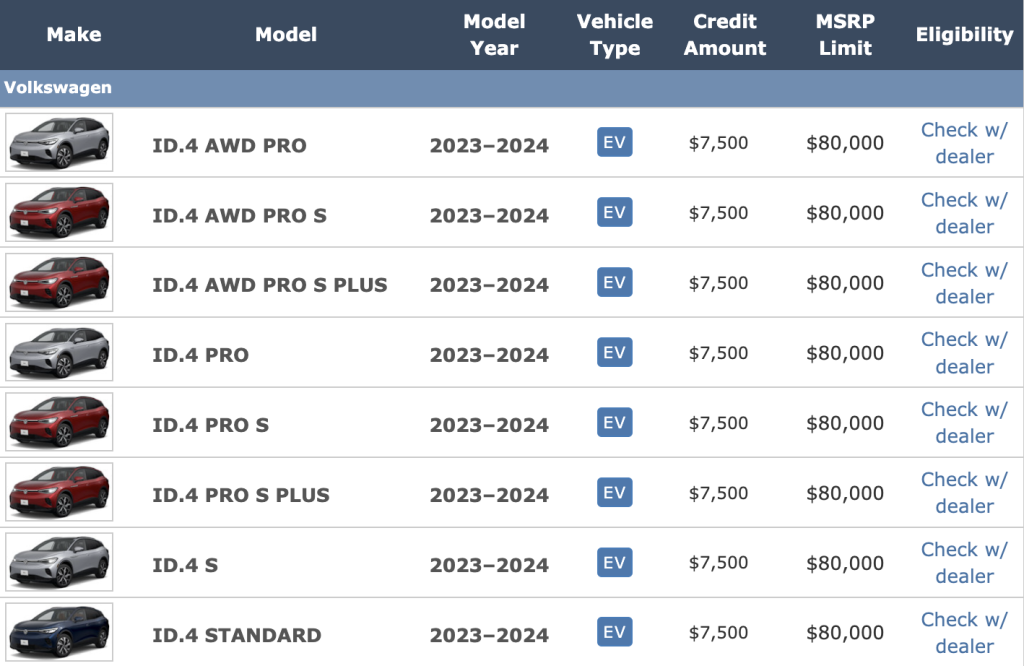

Battery minerals and their place of origin represent a significant portion of the IRA’s maximum credit. Critical battery minerals account for $3,750 out of the $7,500 credit.

In 2023, the applicable percentage was 40%, meaning 40% of the minerals used in EV batteries must be extracted or processed in the United States or a country with a free trade agreement with the US. The IRA’s applicable percentage increases by 10% each year until it reaches 80% in 2027.

Many EVs did not qualify for the full $7,500 tax credit after battery mineral requirements were enforced. The US government has given mineral exemptions to allow automakers to adjust their battery supply chain.

The following lists of EVs qualify for the IRA’s tax credits according to the Internal Revenue Service:

—

Read More US Economic News