Jefferies Initiates Coverage of Southern Company Corporate Bond with ‘Hold’ Rating

Fintel Analysis on Southern Company – Corporate Bond’s Market Performance

As per Fintel’s recent report, Jefferies began coverage of the Southern Company – Corporate Bond (BOIN:SOJE) with a Hold recommendation on September 19, 2024.

Understanding Stock Price Forecasts

As of August 26, 2024, the one-year average price forecast for SOJE is $21.31/share, which represents a decrease of 2.88% from the last closing price of $21.94 / share. The predicted price range is from a low of $17.36 to a high of $24.40.

For more stock insights, check out our leaderboard of companies with the greatest price target upside.

Revenue and EPS Projections

The predicted annual revenue for SOJE is 27,601MM, marking a growth of 5.61%. Meanwhile, the projected annual non-GAAP EPS stands at 4.21.

Fund Sentiment Overview

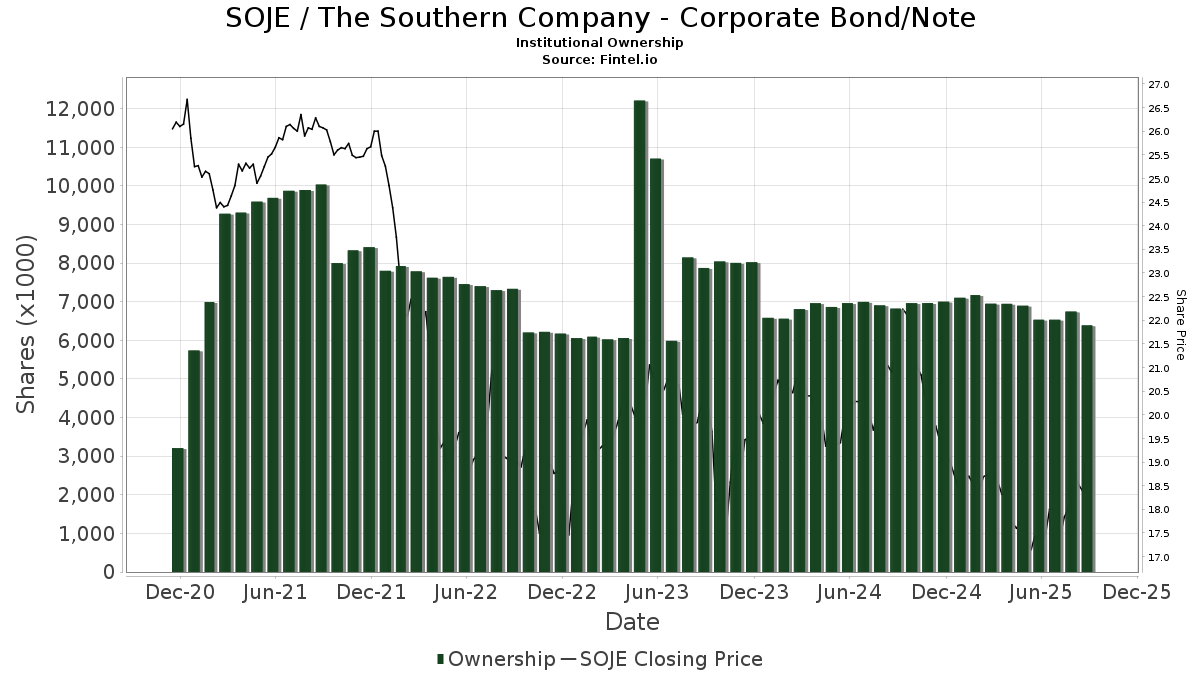

As per Fintel’s data, 19 funds or institutions reported positions in SOJE, indicating a decrease of 9.52% in ownership in the last quarter. The average portfolio weight allocated to SOJE increased by 5.45% to 0.41%. In the past three months, total institutional ownership decreased by 0.01% to 6,963K shares.

What Are Other Shareholders Doing?

Detailed information on the holdings and trading activities of ETFs like PFF – iShares Preferred and Income Securities ETF, PGX – Invesco Preferred ETF, PFXF – VanEck Vectors Preferred Securities ex Financials ETF, PFFD – Global X U.S. Preferred ETF, and PSK – SPDR(R) Wells Fargo Preferred Stock ETF are provided in the full report.

Detailed information on the holdings and trading activities of ETFs like PFF – iShares Preferred and Income Securities ETF, PGX – Invesco Preferred ETF, PFXF – VanEck Vectors Preferred Securities ex Financials ETF, PFFD – Global X U.S. Preferred ETF, and PSK – SPDR(R) Wells Fargo Preferred Stock ETF are provided in the full report.

About Fintel

Fintel offers a comprehensive investment research platform to individual investors, traders, financial advisors, and small hedge funds. We provide world-wide data coverage including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Our exclusive stock picks leverage advanced, backtested quantitative models for improved profitability. To learn more, click here.

Note: This analysis was first published on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Read More US Economic News